What is DocuSign?

DocuSign is a leading electronic signature platform that enables businesses to sign, send, and manage documents digitally. Stripe, on the other hand, is a popular payment processing platform that allows businesses to accept online payments securely. Integrating DocuSign and Stripe brings significant advantages in terms of streamlining payments and simplifying transactions. This blog will explore the benefits, integration process, best practices, real-life use cases, common challenges, security and compliance considerations, and conclude with a summary of key points.

Understanding DocuSign and Stripe Integration

Integrating DocuSign and Stripe brings together the power of electronic signatures and secure payment processing to create a seamless and efficient payment workflow for businesses. With this integration, businesses can streamline their processes by connecting the electronic signature process facilitated by DocuSign with the secure payment collection capabilities of Stripe. This integration allows for a unified system where documents can be signed and payments can be processed seamlessly, resulting in optimized payment workflows and improved operational efficiency.

Benefits of DocuSign and Stripe Integration

Increased efficiency in payment processing

By integrating DocuSign and Stripe, businesses can experience a significant improvement in the efficiency of their payment processing. The combination of electronic signatures and payment collection eliminates the need for manual handling of documents and payments, reducing processing time and eliminating errors. This streamlined process accelerates the payment cycle and enables businesses to receive payments faster, ultimately improving cash flow.

Enhanced security and compliance measures

Both DocuSign and Stripe are committed to maintaining robust security measures to protect sensitive customer data. By integrating these platforms, businesses benefit from the security features and compliance standards of both systems. DocuSign utilizes advanced encryption and authentication methods to ensure the security and integrity of signed documents, while Stripe adheres to industry-leading security standards such as PCI-DSS (Payment Card Industry Data Security Standard) to protect payment data. This integration minimizes security risks and helps businesses meet regulatory and compliance requirements, giving customers peace of mind when transacting.

Improved customer experience and satisfaction

Integrating DocuSign and Stripe creates a seamless and frictionless experience for customers during the payment process. Customers can conveniently sign documents electronically and make payments in a secure and efficient manner. This eliminates the need for manual printing, signing, and mailing of documents, resulting in a faster and more convenient process. The improved customer experience leads to higher satisfaction levels and enhances the overall reputation of the business.

How to Integrate DocuSign and Stripe

To integrate DocuSign and Stripe effectively, businesses can follow these steps:

Step 1: Create accounts on DocuSign and Stripe

If you don’t have existing accounts on DocuSign and Stripe, you’ll need to create them. Visit the respective websites of DocuSign and Stripe and sign up for an account. Make sure to provide all the necessary information and complete any verification processes required.

Step 2: Configure your DocuSign account

Once you have created your DocuSign account, you need to configure it to work seamlessly with Stripe. Access the settings or preferences section in your DocuSign account and navigate to the integrations or API settings. Here, you will find options to connect with external services like Stripe.

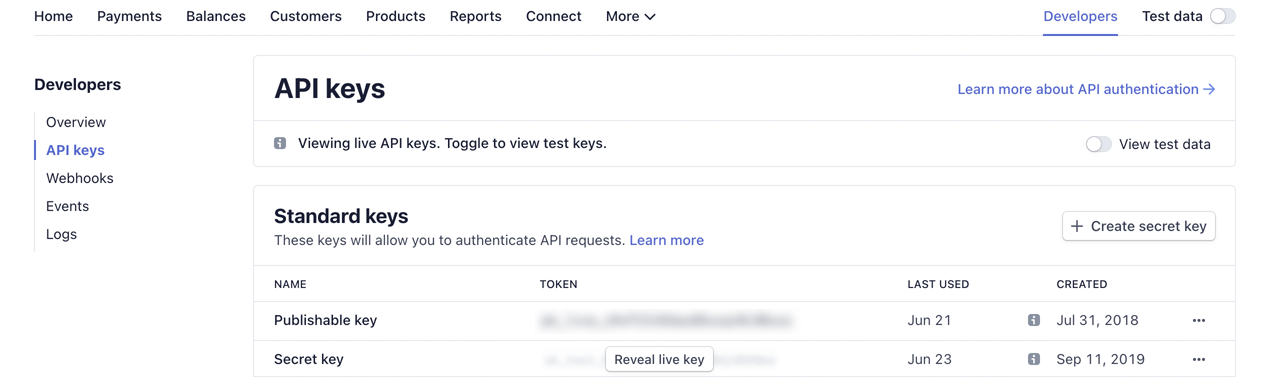

Step 3: Generate API keys in Stripe

Log in to your Stripe account and navigate to the API settings or developer settings section. Generate the necessary API keys that will allow communication between DocuSign and Stripe. These API keys are essential for establishing a secure and authorized connection between the two platforms.

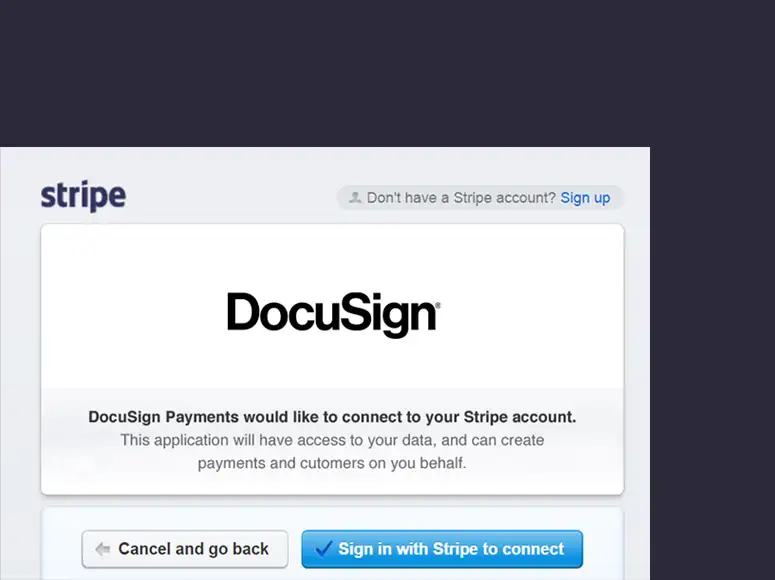

Step 4: Connect DocuSign with Stripe

Return to your DocuSign account and locate the integration or API settings again. Enter the API keys generated from Stripe into the corresponding fields. This step establishes the connection between DocuSign and Stripe.

Step 5: Configure integration settings

Within DocuSign, you will have the option to configure various integration settings. This includes specifying how payment-related events and data should be transmitted to Stripe. Customize the settings according to your business needs, such as defining which events trigger payment processing or setting up notifications for successful transactions.

Step 6: Test the integration

Before fully implementing the integration, it’s crucial to test the setup to ensure it functions correctly. Create sample documents in DocuSign that require signatures and initiate test transactions to verify that the integration successfully captures the payment information and processes it through Stripe.

Step 7: Deploy and monitor the integration

Once you have confirmed the successful integration, deploy it into your live environment. Continuously monitor the integration to ensure its ongoing performance and address any issues or errors that may arise.

Best Practices for Successful Integration

To ensure a successful integration between DocuSign and Stripe, it is important to follow these best practices:

- Choose the right integration strategy: Before starting the integration process, evaluate your business needs, existing systems, and technical capabilities. Determine whether integrating directly via APIs or utilizing third-party integration platforms would be the most suitable approach. Consider factors such as scalability, customization options, and ease of implementation.

- Customize workflows: Tailor the integration to match your specific payment and document workflows. Analyze your existing processes and identify areas where automation can be implemented. Design workflows that minimize manual intervention, streamline the payment collection process, and optimize overall efficiency. For example, automate the generation of invoices, initiate payment collection upon signature completion, and trigger notifications or updates to relevant stakeholders.

- Document and record-keeping: It is crucial to maintain comprehensive documentation of your integration setup, configurations, and processes. Documenting the integration steps, API configurations, and any customizations made will help with troubleshooting, future updates, and training purposes. Additionally, keep a record of any changes or updates made during the integration process to ensure consistency and facilitate maintenance in the future.

- Test and validate: Before deploying the integrated system to your live environment, thoroughly test and validate the integration. Create test scenarios to simulate real-world usage, such as sending sample documents for signing and processing test payments. Verify that all data is being transmitted accurately between DocuSign and Stripe and that the desired actions are being triggered correctly. Identify and resolve any issues or discrepancies during the testing phase to ensure a smooth integration experience for your users.

- Monitor and maintain: Once the integration is live, monitor its performance regularly. Keep track of transactional data, payment success rates, and any error logs. Implement monitoring tools or alerts to be notified of any potential issues or disruptions. Regularly update the integration components, APIs, and plugins to ensure compatibility with the latest versions of DocuSign and Stripe.

Real-Life Use Cases

Numerous businesses across various industries have successfully integrated DocuSign and Stripe to streamline their payment processes. Here are a few real-life use cases:

- E-commerce: Online retailers can leverage the integration to simplify their order fulfillment process. Customers can electronically sign purchase agreements or contracts, while Stripe handles the secure payment processing. This streamlined approach ensures a seamless customer experience and accelerates the order fulfillment process.

- Subscription-based services: Businesses offering subscription-based services, such as software-as-a-service (SaaS) providers or membership platforms, can integrate DocuSign and Stripe to automate recurring payment collection. By combining the electronic signature process with automated payment processing, businesses can streamline the onboarding of new subscribers, ensure timely payments, and reduce administrative overhead.

- Professional services: Law firms, real estate agencies, and other professional service providers can benefit from the integration by streamlining contract signing and payment collection. With DocuSign, clients can electronically sign legal documents or contracts, while Stripe handles secure payment processing, simplifying the entire process and reducing paperwork.

Common Challenges and Troubleshooting

During the integration process of DocuSign and Stripe, you may come across some common challenges. Here are a few examples along with troubleshooting tips:

- Configuration errors: It is possible to encounter configuration errors during the integration setup. Double-check the integration settings in both DocuSign and Stripe to ensure that all required fields are correctly mapped. Review the API documentation provided by both platforms and verify that you have entered the correct information, such as API keys, endpoints, and callback URLs.

- API connectivity issues: Connectivity issues with APIs can sometimes occur, resulting in communication problems between DocuSign and Stripe. Verify that the API credentials provided by each platform are accurate and properly configured. Ensure that the API endpoints are accessible and that the necessary firewall or network configurations are in place to allow communication between the systems.

- Testing and sandbox environments: Utilize the testing and sandbox environments provided by DocuSign and Stripe for thorough testing of the integration. This allows you to simulate real-world scenarios without affecting live data or transactions. Ensure that you are using appropriate test data, such as sample documents and test payment information, to validate the integration and identify any potential issues.

In case you encounter any challenges or errors during the integration process, consult the official documentation and support resources provided by DocuSign and Stripe. Reach out to their respective support teams for assistance and follow their troubleshooting guidelines specific to your situation.

Security and Compliance Considerations

When integrating DocuSign and Stripe, it is crucial to prioritize security and compliance to protect customer data and ensure legal compliance. Consider the following aspects:

- Data privacy and protection: Ensure that all customer data transmitted between DocuSign and Stripe is encrypted and protected using industry-standard security protocols. Both platforms employ encryption mechanisms to safeguard sensitive information. Verify that HTTPS is used for all data transmission and storage, and implement additional security measures such as two-factor authentication to further protect user accounts.

- Compliance with regulations: Understand and comply with relevant regulations, such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA). Familiarize yourself with the specific requirements related to data protection and privacy in your jurisdiction. Implement necessary measures, such as obtaining user consent for data processing and providing options for data deletion or retention as per the applicable regulations.

- Payment card security: If you are processing credit card payments through Stripe, ensure that your integration adheres to the Payment Card Industry Data Security Standard (PCI-DSS). Stripe is certified as a Level 1 PCI-DSS-compliant service provider, which means it meets the highest level of security standards. However, it is essential to ensure that your integration and handling of payment data also meet the necessary PCI-DSS requirements.

Regularly review the security practices and updates provided by both DocuSign and Stripe to stay up to date with any new features or security enhancements. Additionally, consult with legal and compliance professionals to ensure your integration aligns with the specific regulations and standards applicable to your business and industry.

Conclusion

Integrating DocuSign and Stripe offers a powerful solution for streamlining payments and simplifying transactions. By combining the benefits of electronic signatures and secure payment processing, businesses can achieve increased efficiency, enhanced security, and improved customer satisfaction. Whether you’re in e-commerce, professional services, or any other industry, exploring the integration between DocuSign and Stripe can revolutionize your payment workflows.

To leverage the full potential of DocuSign and Stripe integration and ensure a seamless implementation, consider partnering with Ubique Digital Solutions. Our team of experts will guide you through the integration process, tailor the solution to your unique business needs, and provide ongoing support. Don’t miss out on the opportunity to boost your business to success. Contact Ubique Digital Solutions today and embark on your journey towards optimized payment workflows and simplified transactions.

FAQs

Q: Is it difficult to set up the integration between DocuSign and Stripe?

The difficulty level of setting up the integration depends on your technical expertise and the integration method you choose. Some integration options may require coding and development skills, while others offer user-friendly interfaces for easier setup.

Q: How secure is the integration between DocuSign and Stripe?

Both DocuSign and Stripe prioritize security and comply with industry-standard security protocols to ensure the protection of sensitive data during the integration process. They employ encryption measures, secure authentication, and undergo regular security audits to maintain the highest level of security.

Q: Can DocuSign and Stripe integration be used in any industry?

Yes, DocuSign and Stripe integration can be utilized in various industries, including e-commerce, professional services, healthcare, finance, and more. The versatility of the integration allows businesses across different sectors to streamline their payment workflows and enhance operational efficiency.

Q: Are there any limitations or restrictions when using DocuSign and Stripe integration?

While DocuSign and Stripe’s integration offers robust features and functionality, it’s important to review their documentation and terms of service to understand any specific limitations or restrictions that may apply. These could include usage limits, compatibility requirements, or regional availability of certain features.