Stripe vs Square

Stripe and Square are two popular payment processing platforms that provide businesses with the tools and infrastructure to accept payments from customers. While both platforms offer similar services, it is crucial to choose the right payment processor that aligns with your specific business needs. This comparison guide will dive into the key features, functionality, ease of use, security, compliance, and customer support of Stripe and Square, helping you make an informed decision.

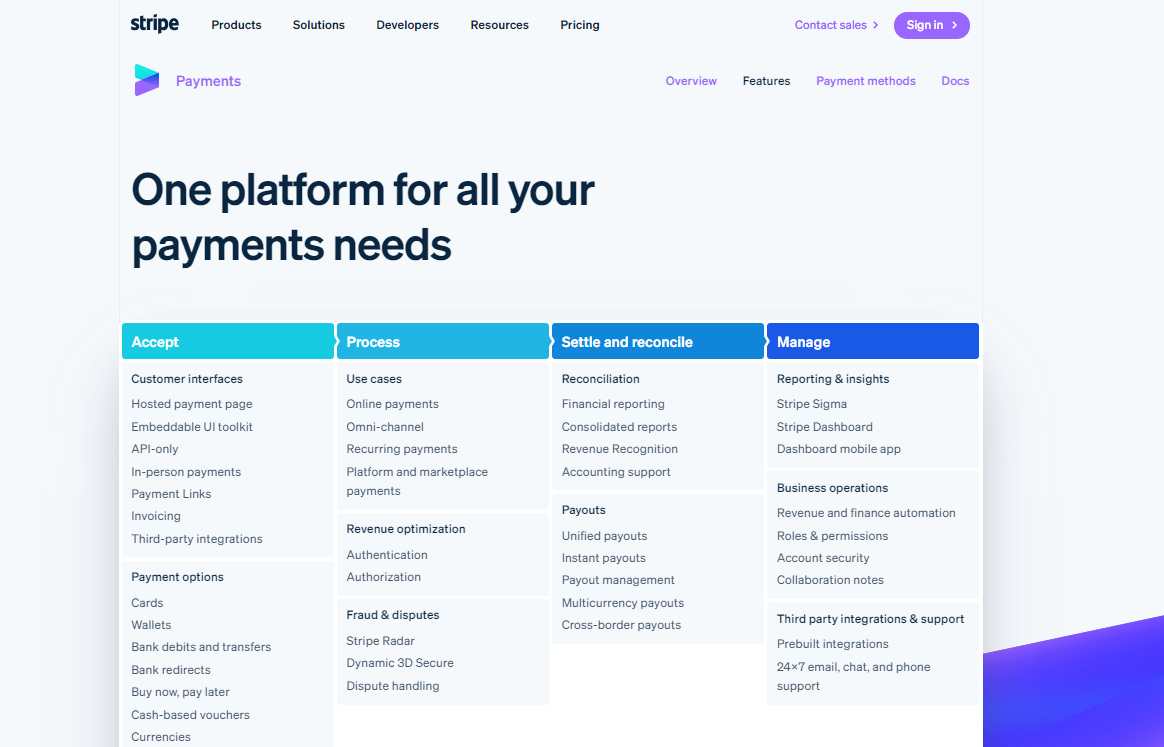

What are the Functions of Stripe?

Stripe offers a wide range of functions and features that enable businesses to handle online payment processing effectively. Here are the main functions of Stripe:

Payment Processing

Stripe allows businesses to accept online payments securely and seamlessly. It provides a robust infrastructure for processing credit and debit card payments, as well as alternative payment methods like digital wallets and bank transfers.

Developer-Friendly Integration

Stripe offers a developer-friendly platform with extensive APIs, libraries, and documentation. It allows businesses to integrate Stripe’s payment processing capabilities into their websites, mobile apps, or other software applications smoothly and customize the payment experience as per their requirements.

Subscription and Recurring Billing

Stripe supports subscription-based businesses by enabling recurring billing. It provides flexible options for managing subscription plans, handling upgrades and downgrades, and automating recurring charges.

International Payments

With Stripe, businesses can accept payments from customers around the world. It supports various currencies and payment methods, making it easier to expand globally and reach a broader customer base.

Fraud Prevention

Stripe incorporates advanced fraud detection mechanisms to protect businesses from fraudulent transactions. It utilizes machine learning algorithms and behavioural analytics to identify and prevent potentially fraudulent activities.

Financial Reporting and Analytics

Stripe offers comprehensive reporting and analytics tools to help businesses gain insights into their payment data. It provides detailed transaction records, financial summaries, and customizable reporting options, enabling businesses to track revenue, monitor performance, and make data-driven decisions.

Checkout and Payment Pages

Stripe provides pre-built payment interfaces and checkout flows that businesses can quickly integrate into their websites or apps. These ready-to-use components help streamline the payment process and enhance the user experience.

Mobile Payments

Stripe supports mobile payments, allowing businesses to accept payments within their mobile applications. It provides SDKs and mobile-optimized tools for a seamless payment experience on various mobile platforms.

Payouts and Transfers

Stripe enables businesses to transfer funds to their connected bank accounts easily. It offers customizable payout schedules, automated transfers, and tools for managing funds efficiently.

Customer Support

Stripe provides customer support to assist businesses with any payment-related issues or inquiries. It offers support through email, chat, and phone, with round-the-clock availability for higher-tier plans.

These functions make Stripe a comprehensive payment processing solution, empowering businesses to handle online payments securely, efficiently, and with flexibility.

Get 10-15% discount on Stripe! Contact Us.

Functions of Square

Square offers a range of functions and features that help businesses manage their payments, both online and in-person. Here are the main functions of Square:

Point of Sale (POS) System

Square provides a comprehensive POS system that allows businesses to accept payments in person. It includes hardware options like card readers, terminals, and registers, along with a dedicated point-of-sale app for processing transactions and managing sales.

Online Payment Processing

Square enables businesses to accept online payments through customizable payment forms, hosted payment pages, and e-commerce integrations. It supports various payment methods, including credit and debit cards, digital wallets, and online invoicing.

Mobile Payments

Square offers a mobile payment solution that allows businesses to accept payments using smartphones or tablets. The Square Point of Sale app turns mobile devices into portable card readers, making it convenient for businesses on the go or in non-traditional locations.

E-commerce Tools

Square provides tools for businesses to build and manage their online stores. This includes features such as inventory management, order fulfillment, and integration with popular e-commerce platforms.

Payment Processing APIs

Square offers developer-friendly APIs and SDKs that allow businesses to integrate Square’s payment processing capabilities into their software applications. This enables custom payment flows, automation, and seamless integration with other business systems.

Subscription Management

Square provides functionality for businesses that offer subscription-based products or services. It allows businesses to set up recurring billing, manage customer subscriptions, and handle plan customization.

Financial Reporting and Analytics

Square offers detailed reporting and analytics tools that provide insights into sales, transactions, and customer behaviour. Businesses can access data on revenue, inventory, and other key metrics to gain a deeper understanding of their performance.

Payouts and Transfers

Square facilitates quick and flexible fund transfers to a connected bank account. It offers options for scheduled or instant transfers, helping businesses access their funds efficiently.

Customer Engagement

Square provides tools for customer relationship management (CRM) and marketing. It allows businesses to build customer directories, send email marketing campaigns, and create loyalty programs to engage with their customers effectively.

Square Capital

Square offers financing options through Square Capital, providing businesses with access to loans to support their growth and operations.

Customer Support

Square provides customer support through email, phone, and live chat. Support hours may vary by region, and additional support is available for higher-tier plans.

Stripe vs Square: Which is Better?

Stripe and Square are both popular payment processing services, but which is the best choice for your business?

- Stripe payment processing specializes in mobile- and online-focused tools that support debit and credit card transactions, as well as online payments.

- Square focuses on providing hardware POS solutions for brick-and-mortar businesses or larger online enterprises.

- Stripe is easy to use and versatile; Square is also easy to use, but it’s not quite as versatile in terms of accepted currencies.

Similarities between Stripe and Square

- Processing costs: Stripe and Square have the same online payment processing cost – 2.9% plus 30 cents per transaction.

- Hardware: Both offer POS hardware like card readers or POS terminals and online payment processing.

- Integration: Both can integrate with third-party tools.

- Customer support: Both offer multiple customer support channels.

Here’s a comparison table outlining the key features and differences between Stripe and Square:

| Feature | Stripe | Square |

| Payment Processing | Offers extensive payment processing capabilities, including recurring payments and international support. | Provides payment processing for online, in-person, and mobile transactions. |

| Transaction Fees | Transparent pricing with customized rates based on business volume. | Clear and simple pricing with fixed rates per transaction and additional fees for certain features. |

| E-commerce Tools | Offers robust API and developer-friendly tools for seamless integration and customization. | Provides e-commerce tools, including a free online store and inventory management. |

| Point of Sale | Primarily focused on online payments, although it supports some in-person payments via integrations. | Specializes in in-person transactions with a range of hardware options and a dedicated point-of-sale app. |

| Subscription | Supports subscription billing with flexible options for recurring charges and plan customization. | Offers subscription management features with various pricing models and plan management capabilities. |

| International Availability | Allows businesses to accept payments globally, with support for various currencies and payment methods. | Supports payments in multiple countries, currencies, and offers localized solutions in some regions. |

| Payouts | Enables automatic transfers to connected bank accounts with customizable payout schedules. | Offers flexible payout options, including instant transfers to linked bank accounts or Square Card. |

| Developer Support | Provides extensive documentation, libraries, and strong developer community support. | Offers developer-friendly APIs, SDKs, and tools, along with a developer portal for integration assistance. |

| Customer Support | Offers 24/7 support via email, chat, and phone, with priority support for higher-tier plans. | Provides customer support through email, phone, and live chat, with support hours varying by region. |

How to Choose: Stripe or Square?

Choosing between Stripe and Square for payment processing largely depends on your specific business needs, preferences, and the nature of your operations. Both platforms are highly reputable, but they cater to different use cases and offer varied features. Here’s a comparison to help you make an informed decision:

Business Model & Use Case

Stripe: Well-suited for online businesses, especially those needing advanced customization, international capabilities, and integrations. Ideal for subscription-based models, e-commerce stores, and platforms with unique payment requirements.

Square: Designed primarily for brick-and-mortar businesses, Square offers point-of-sale (POS) solutions. While they’ve expanded to online payments, their strength lies in in-person transactions.

Ease of Use

Stripe: Might have a steeper learning curve, especially if you want to take advantage of its powerful API and customization options. However, it offers rich documentation to assist developers.

Square: Known for its user-friendly interface, especially for physical stores. The out-of-the-box POS system is easy to set up and navigate.

Payment Solutions

Stripe: Strong focus on online payment solutions with a highly customizable API, subscription billing, mobile payments, and more.

Square: Offers a broader range of hardware for in-person payments, including card readers, terminals, and registers. They also have online payment solutions, but the emphasis is on physical POS.

Pricing

Stripe: Typically charges a flat fee per online transaction. Rates might vary based on volume or specific requirements.

Square: Pricing varies based on the type of solution (e.g., POS, online, invoicing). They often offer a flat fee per swipe, dip, or tap for card transactions.

International Capabilities

Stripe: Strong international capabilities, supporting hundreds of currencies and various payment methods around the world.

Square: More limited in international reach compared to Stripe, though it has been expanding.

Integration & Customization

Stripe: Known for its robust API, allowing businesses to create custom payment experiences and integrate with a plethora of third-party applications.

Square: Offers APIs and SDKs as well, but Stripe usually gets the nod from developers seeking deep customization.

Additional Features

Stripe: Stripe Atlas (helping startups get incorporated), Stripe Radar (fraud detection), Stripe Capital (business financing), etc.

Square: Employee management, inventory management, Square Capital (loans), appointment scheduling, and more.

Customer Support

Both offer multiple channels of support, but it’s always a good idea to review user feedback to gauge the quality and responsiveness of their respective support teams.

Recommendation

- Online-only business with a need for customization – Stripe might be a better choice.

- Physical stores needing POS solutions or a mix of online and offline sales – Square might be more appropriate.

However, always keep in mind that business needs can vary widely, and what works best for one might not work as well for another. It’s a good idea to analyze your specific requirements, possibly try out both systems and see which aligns best with your operations.

Conclusion

Both Stripe and Square are reputable payment processing platforms with their strengths and capabilities. Stripe stands out for its extensive integration options, powerful API, and advanced subscription management features, making it an excellent choice for businesses focused on online transactions and recurring payments. On the other hand, Square offers a comprehensive suite of tools, including POS solutions and hardware offerings, making it well-suited for businesses that require in-person payment acceptance and additional business management features. Ultimately, the decision between Stripe and Square depends on your specific business needs, preferences, and the nature of your transactions.

To take your business to the next level and ensure a seamless payment processing experience, consider partnering with Ubique Digital Solutions. Our team of experts specializes in helping businesses integrate and optimize payment systems, providing personalized solutions tailored to your unique requirements. Boost your business to success by following our blog for more valuable insights and industry updates. Contact UDS today to discuss how we can help you achieve your business goals.

FAQs

Q: What is the difference between Stripe and Square?

Stripe and Square differ in terms of their features, pricing structures, target audiences, and integration options. While both platforms provide payment processing services, Stripe emphasizes customization, advanced integration capabilities, and subscription management, while Square offers a broader range of features, including point-of-sale solutions and hardware offerings.

Q: Which payment processor is better for e-commerce businesses?

Both Stripe and Square are suitable for e-commerce businesses, but the choice depends on specific requirements. Stripe’s strong API integration and subscription management features make it well-suited for businesses with recurring payments, while Square’s comprehensive suite of tools, including in-person payment acceptance and inventory management, can benefit businesses with a physical and online presence.

Q: How do Stripe and Square compare in terms of pricing?

Stripe and Square have different pricing structures. Stripe typically charges a percentage-based fee per transaction, varying by region and payment method, while Square offers transparent pricing with fixed transaction fees and hardware costs. The best way to determine which platform is more cost-effective for your business is to evaluate your transaction volume and specific needs.

Q: Can I use both Stripe and Square simultaneously?

Yes, it is possible to use both Stripe and Square simultaneously. Some businesses may opt to leverage the different strengths of each platform for specific purposes. For instance, using Stripe for online transactions and Square for in-person sales. Integration with other software or platforms may be required to manage the simultaneous use of both processors effectively.

Q: Do Stripe and Square offer international payment support?

Both Stripe and Square offer international payment support. They enable businesses to accept payments in multiple currencies and provide tools for handling cross-border transactions. However, specific features and country availability may vary, so it is important to review their documentation or contact their support teams for detailed information.