What is Wise?

Wise provides an alternative to traditional banks, offering lower fees and competitive exchange rates.

Wise, formerly known as TransferWise, is an international money transfer service designed to make cross-border transactions more affordable, transparent, and efficient. It utilizes peer-to-peer technology to match transfers and reduce currency conversion costs.

How Does Wise Money Transfer Work?

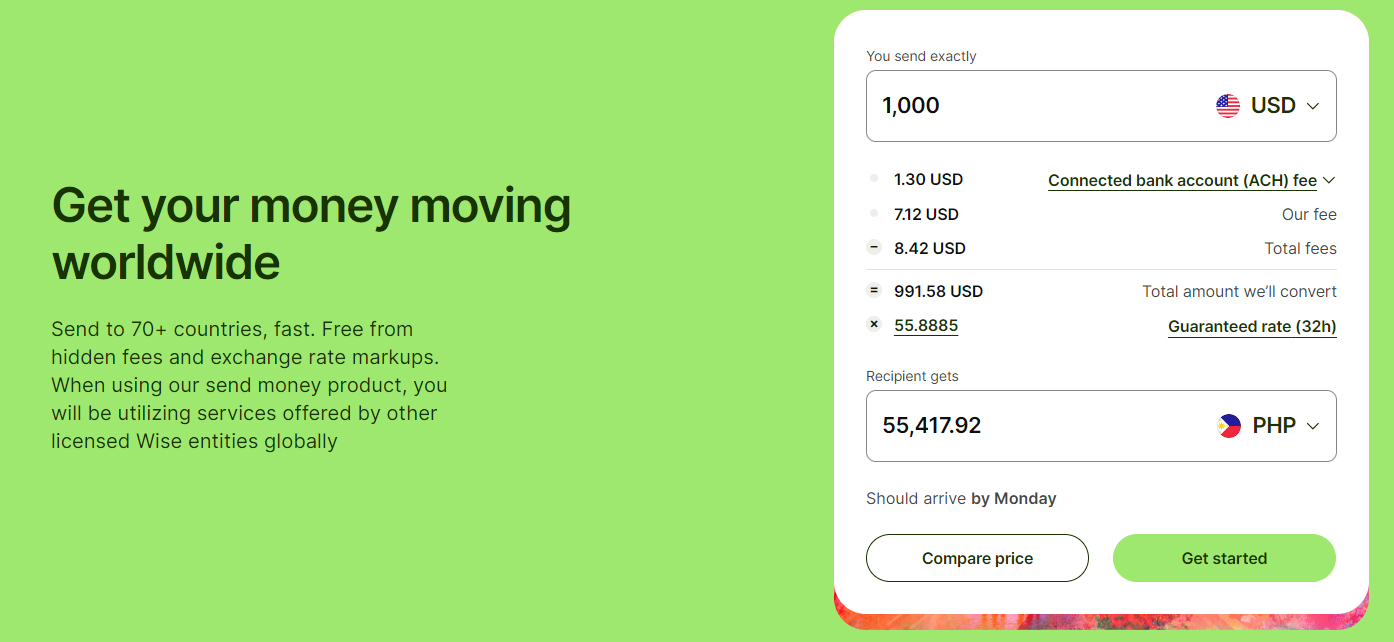

Transparency in Fees and Exchange Rates

One of Wise’s core strengths is its commitment to transparency. It openly displays the fees users will incur before confirming a transfer. Additionally, Wise provides the mid-market exchange rate, which is the real exchange rate without any hidden markups. This allows users to know exactly how much money will be sent and received, without surprises due to fluctuating rates or hidden charges.

Peer-to-Peer Transfer System

Wise operates a unique peer-to-peer system that matches user transfers with someone sending money in the opposite direction. By doing so, Wise can minimize or eliminate the need for traditional currency conversion, resulting in fairer and more competitive exchange rates.

Local Transfers for Faster Processing

Wise leverages a network of local bank accounts in various countries to send and receive funds. This approach speeds up the transfer process significantly, as the money does not need to physically cross borders. For instance, if someone in the US wants to send money to the UK, Wise uses its US bank account to pay out the recipient from its UK account, cutting down processing time.

Step-by-Step Process of Using Wise

- Creating a Wise Account and Verifying Identity: Users begin by signing up on the Wise platform, providing personal information, and verifying their identity as per regulatory requirements in their respective countries.

- Setting Up a Transfer: Users specify the amount they wish to send, the destination currency, and the recipient’s details. This includes providing the recipient’s banking information to ensure a smooth transfer.

- Currency Conversion Process: Wise matches the user’s transfer with someone sending money in the opposite direction, thus avoiding the traditional currency conversion process. By doing this, Wise can offer its users better exchange rates.

- Sending and Receiving Funds: Funds are sent from the user’s account to Wise’s account in the sender’s country. Wise then uses its account in the recipient’s country to send the funds directly to the recipient’s account, minimizing the time and costs typically associated with international transfers.

Advantages of Using Wise

- Lower Fees Compared to Traditional Banks: Wise generally charges lower fees than traditional banks, which are transparently displayed before users confirm their transfers. This transparency helps users to know the exact cost upfront, without any hidden charges.

- Competitive Exchange Rates: By providing the mid-market rate, Wise ensures users get fair and competitive exchange rates, avoiding the extra markups often seen with traditional banks or money transfer services.

- Transparency and Tracking Capabilities: Users have access to real-time tracking, enabling them to see precisely how much money will be sent and received, from the moment the transfer begins until it reaches the recipient. This transparency provides peace of mind and control over the entire process.

Wise Fees and Exchange Rates

1. Fee Structure of Wise

- Clear Breakdown of Fees: Wise utilizes a transparent fee structure. The fees are usually a percentage of the amount being transferred and vary depending on the currencies involved and the transfer amount. Before confirming the transfer, Wise displays the fees so that users know exactly how much they will be charged.

- Comparison with Traditional Bank Fees: Compared to traditional banks, Wise generally offers lower fees for international money transfers. This is a significant advantage for users seeking a more cost-effective solution.

2. Exchange Rates in Wise

- Mid-Market Rates: Wise provides its users with the mid-market exchange rate. This rate is the real, midpoint exchange rate between the buy and sell prices on the global currency markets. It’s not marked up, ensuring users receive fair and transparent rates. The mid-market rate ensures that users are not subjected to inflated exchange rates, which traditional banks often apply for their profit. This provides users with a more accurate understanding of the value of their money during the transfer process.

3. Hidden Costs to Be Aware of

- Addressing Additional Charges or Costs: While Wise is transparent about its fees, there might be additional costs associated with certain types of transfers. These could include fees charged by credit card companies, intermediary banks, or the recipient’s bank.

- Calculating the Total Cost of a Transfer: To ensure users have a clear understanding of the total cost of a transfer, they should consider not only the fee charged by Wise but also potential additional fees that might be levied by other institutions involved in the transaction. This comprehensive approach helps in accurately estimating the final cost of the transfer.

Customer Reviews: Pros and Cons

Pros:

- Excellent experience with Wise for holiday bookings. Best currency rates, reasonable fees, and smooth card usage abroad. -Ian G, Trustpilot 2024

- Wise is straightforward and quick, with low fees. However, customers would appreciate a helpline for live assistance, especially during transitions in airports. -Maha F, Trustpilot 2024

Cons:

- Despite a transfer mistake, prompt assistance from the helpline resolved the issue swiftly, though clearer website instructions could prevent such errors in the future. -Roger, Trustpilot 2024

- While satisfied with the service overall, my card wasn’t recognized at major retailers. -Stoyan D, Trustpilot 2024

- Experiencing a delay in money transfer processing and confusion with displayed balances, I hope for clearer tracking of linked funds and faster support response times in the future. -Lana, Trustpilot 2024

Is Wise Money Transfer Safe and Reliable?

1. Security Measures Implemented by Wise

Two-factor authentication and encryption

Wise incorporates two-factor authentication (2FA) as a critical component of its security framework. This feature adds an extra layer of security by requiring not only a password and username but also something that only the user has on them, like a mobile device. This method significantly reduces the risk of unauthorized access to accounts.

Regulatory compliance and licenses

Operating in the financial sector, Wise adheres to strict regulatory standards. It holds licenses from numerous financial authorities across the countries it operates in, such as the Financial Conduct Authority (FCA) in the UK and corresponding bodies in other regions. This compliance is not just a legal requirement but also serves to reassure users of the legitimacy and safety of the service. Wise’s adherence to these regulations means it must follow stringent rules regarding customer protection, financial reporting, and risk management, thereby ensuring a secure and reliable service for its users.

2. Common Concerns Addressed

Issues related to delays or failed transfers

While Wise is generally efficient, issues such as transfer delays or failures can occasionally occur, often due to external factors like bank processing times or compliance checks. Wise proactively addresses these concerns by providing timely updates and transparent communication to the affected users. Their customer support team is trained to handle such situations efficiently, ensuring that users are not left in the dark about the status of their transactions.

How Wise handles customer support and conflict resolution

Wise’s approach to customer support and conflict resolution is centred around accessibility and effectiveness. Customers can reach out through various channels, including email, phone, and in-app support. The support team is equipped to handle a range of issues, from technical glitches to transaction inquiries. In cases of disputes or conflicts, Wise follows a structured process to ensure fair and prompt resolution. This process involves investigating the issue, communicating clearly with the customer, and taking appropriate actions to rectify the situation, which may include refunds or other compensatory measures. This comprehensive support system plays a crucial role in maintaining customer satisfaction and trust.

Key Takeaways

Wise offers a convenient and efficient platform for international money transfers, with generally positive feedback from users. However, it’s essential to remain vigilant and double-check instructions to avoid potential errors. When using any money transfer service, including Wise, always ensure that you’re aware of any associated fees, familiarize yourself with the platform’s features, and keep track of your transactions. Additionally, consider exploring other payment options in the market to find the best fit for your specific needs and preferences. Happy transferring!

FAQs

Q: Is Wise safe as a bank?

While Wise isn’t a bank, it employs high-security measures and is regulated like a bank, making it generally considered safe for local and international transfers.

Q: How long does it typically take for a Wise transfer to reach the recipient?

Transfer times vary but typically take 1-4 business days, depending on the destination and the chosen transfer speed.

Q: Are there any limits on the amount that can be transferred through Wise?

Yes, Wise has different limits depending on the currency and the user’s verification status. Limits can be found on the Wise website.

Q: Does Wise support all currencies for international transfers?

Wise supports a wide range of currencies for international transfers. However, some exotic or restricted currencies might not be available.

Q: Can I cancel or modify a transfer on Wise after initiating it?

Whether a transfer can be cancelled or modified depends on the status of the transfer. It’s advisable to contact Wise’s customer support for assistance in such cases.

Q: Is Wise legal in Australia?

Yes, Wise is legal in Australia.

Q: Is Wise an actual bank account?

No, Wise isn’t a traditional bank account; it’s a service for international money transfers.